As your author business grows, it becomes more complex. In addition to books, maybe you’ve added a class, or merchandise, or make appearances and sell books at events. Making sure you have somewhere to accurately record all of your income and expenses will simplify your life come tax time. Needing a tool for my own businesses, I developed this spreadsheet to better understand what’s happening in real-time quickly and easily. When tax time rolls around, I can send the needed parts of this spreadsheet to my accountant.

You can download the spreadsheet here, and I’ll walk you through the basics. It was created to adapt, delete, or change to suit your business best. I make one or two updates each year as my business evolves, so think of this as a starting point for your own business, and change as needed.

This was created for a Limited Liability Corporation (a form of incorporation in the US that provides tax and legal benefits and protections), paying myself bimonthly. The dates on the tables follow the “Cash Basis” bookkeeping method. If you pay yourself monthly or weekly, add or delete rows to accommodate your business model. Dummy data is included for demonstration purposes.

Checking

The first sheet is the checking account register. In addition to my checking account, I accept payment via PayPal, so it’s merged here. You can duplicate this sheet and use it for each of the accounts where you receive funds.

Pro-Tip: Try sorting the sheet and see how the display as you evaluate its effectiveness for you.

The top table is automatically tallied by the category you list things under in the second table.Change these to fit those that apply for your business and the taxable deductions in your country and any other things you want to monitor over time. Simply change the category title and use it when you fill out the register below.

The second table is where you enter all the information. It works just like a checking account register, using Type, Date, and Description. Type is where I enter check numbers that I write for my office rent, the only paper check I write each month. I designate PayPal entries with “PP” so I can sort all of those easily. Date, Description, and Amounts are self-explanatory. The power of this table is in the Category column. When you categorize an expense or deposit, it is automatically tallied above and ready for tax time.

Goal Tracker

I like to set and track goals in two ways. One for the business overall, and then for individual aspects.. I keep track of all the goals on this sheet. Entering a number in the Words column, registers how many entries made in the cell below them and the totals. This number is what’s used to track averages. The goal is listed at the bottom, so I can see how well I’m tracking with the monthly averages.

To the right, the total income less monthly expenses is shown, and gives a monthly profit total. The monthly expenses number is pulled from the second to the last sheet, Annual Expenses.

Progress

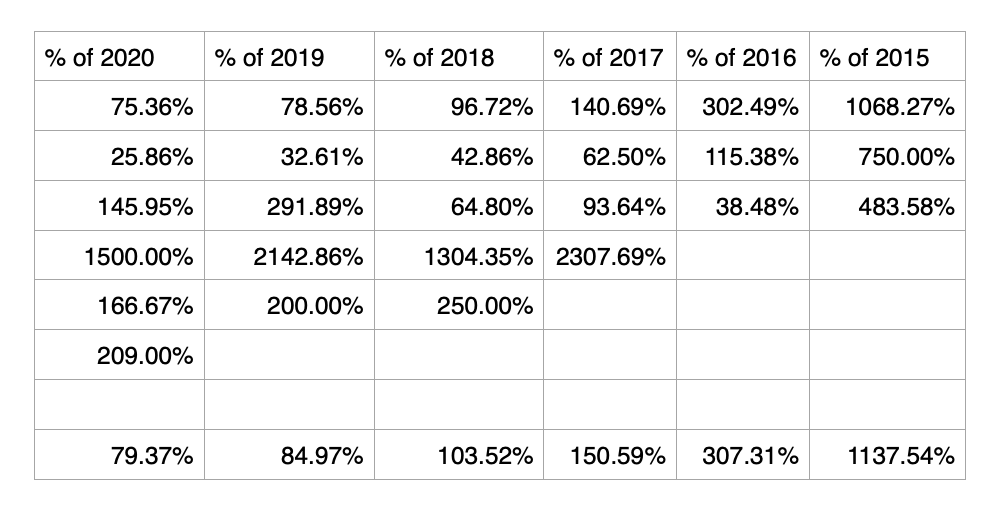

On this sheet, I track how I’m doing from year to year. In January 2022, I’ll add a column between 2020 and 2021 and type in the totals from 2021 and change the titles of the columns above. The data in the last column is automatically pulled from the other sheets, so that is always the current year and I don’t have to repopulate those formulas each time. In the example I’ve provided, you can see the theoretical progress of each year since I began in 2015.

The third table shows what percentage of an entire year each month is. If I’m at 50% of the previous year in March, then I know I’m ahead of where I was at the same time the year before. You can refer to the graphs for a visual representation of the data.

Book Sales

As a wide author, I track royalty income from several retail sources. Instead of accrual-based accounting, when you enter amounts when the sale is made, I use cash basis, so the income is added to the sheet when the money is received. The biggest advantage to this method is the accuracy of the royalty amount, as well as seeing the income in one currency.

The total is automatically entered at the right and then the grand total is tallied at the top of the column and entered into the appropriate cell on the Progress sheet. I manually enter the sum for the month, highlighting and dragging the sum formula into the correct cell. I can then track how I’m doing month to month on the graph to the right.

Merch

If you sell merchandise, you can track those sales at varying levels of detail on this sheet. You’ll see it has options for great detail—but if your store takes off, you may wish to just enter weekly or monthly totals here. Note the tax column and use it for the appropriate taxes or VAT where applicable.

Events

When I sell books and merchandise at in-person events, I record the sales detail in a notebook and transfer those numbers to this sheet.. I record expenses such as booth fees, giveaway costs, food and drinks, business licenses. Use the table below to itemize those but also itemize them on the checking register so they’re flagged for tax deduction, if applicable.

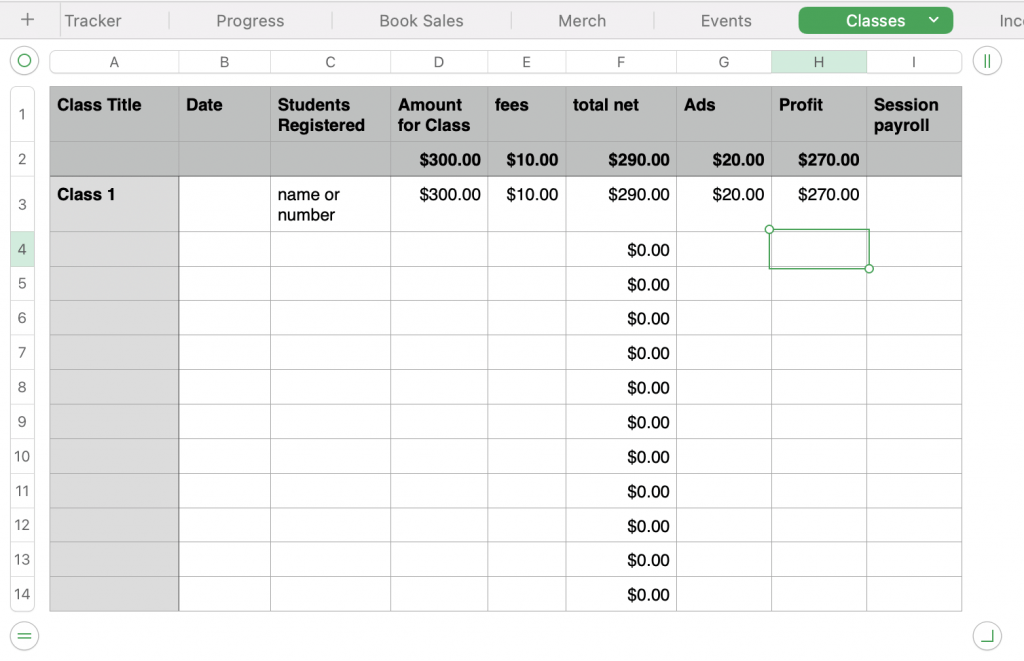

Classes and Income

Stream 1

Stream 1

Use these sheets for additional income streams, and track progress, making note of increases in class enrollment or revenue.

Series 1

This sheet tracks series sales, rather than single book sales, giving you added insight.. If you use it in addition to the Book Sales sheet, remember to delete that row from the progress table, so sales aren’t duplicated.

Editing

For a longer series, I added an editor on retainer and I needed to keep track of those expenses more than I usually do. This optional sheet gives you that option, with added flexibility to add more detail.

Covers

If you use multiple designers, or purchase premade covers frequently, this sheet will help you track how much you’ve spent, but also the purchase details such as how to get in touch with the designer. Enter the details of upgrades for print or audio, or social graphics, and the sheet will tally your total to the right, and your grand total for the year at the top right.

Annual Expenses

This sheet tracks all of your recurring expenses for websites, insurance, software subscriptions, classes you’re taking, and more. If it’s an annual amount, divide that by twelve to amortize that over the year. The total here is what populates that field on the Goal Tracker sheet.

Start-Up Loan

If, like me, you self-funded your business, then you might want to track the amount of money your business owes you.

This spreadsheet offers a way to track all areas of your publishing business. Add or remove items so it’s tailored to your specific needs. Use this example as an idea generator.